Hedge fund managers playing poker and investment gurus using their skills in casinos are part of the contemporary mythology surrounding the world of finance. This makes it surprising that when Merton listed the functions performed by financial markets and institutions he did not include a very important one: entertainment. Had he considered early modern Europe, the striking resemblance between a casino and a stock exchange would certainly not have eluded him.

Béguin K. (2005) Finance in times of uncertainty

January 16, 2010Béguin, Katia (2005) La circulation des rentes constituées dans la France du XVIIe siècle. Une approche de l’incertitude économique. Annales. Histoire, Sciences Sociales, 60/5 : 1229-1244.

Vodpod videos no longer available. Molière “L’Avare” Read the rest of this entry »

Kindleberger C. (1991) An early manic episod

December 25, 2009Kindleberger, Charles P. (1991) The economic Crisis of 1619 and 1623. The Journal of Economic History, 51/1 : 149-175.

Introduction

The early European 17th century has commonly been described as the troublesome transition from a medieval to a modern economy (p.149). The multi-layered crisis of 1619-23 is a perfect embodiment of the woes of the time. However, the author’s “interest in that crisis does not concern its potential role as a catalyst of modern economies, but rather its function in the mechanism for the spread of a primarily financial crisis from one part of Europe to another” (p.150). Read the rest of this entry »

DuPlessis R. & Howell M. (1982) Killing capitalism in its craddle (twice)

November 21, 2009DuPlessis, Robert S. and Martha C. Howell (1982) Reconsidering the Early Modern Urban Economy : The Case of Leiden and Lille. Past and Present, 94/, 49-84.

In Marx’s view, capitalism had arisen in the late Middle Ages out of a production system dominated by lords and guilds. In this framework, urban economies can be regarded as the craddle of capitalism (p.44), the places where capital and labour were separated through the use of putting-out, or the hiring of a migrant or female workforce (p.45). However some cities, such as Leiden and Lille where artisans remained proprietors of their means of production, still managed to integrated the very competitive European textile market (p.46). Read the rest of this entry »

Murphy A. (2009) The smartest boys in the alley, early derivatives on the London stock market

October 24, 2009Murphy, Anne L. (2009) Trading options before Black-Scholes: a study of the market in late seventeenth-century London. Economic History Review, 62/1: 8-30.

The ledger of the financial broker Charles Blunt contains the details of some 1,500 transactions realized between 1692 and 1695, about a third of which regard the then novel trade in equity options (p.9). The technique had arisen in the 1620s in the commodity market and was proving very useful in the decade following the Glorious Revolution, when some 100 joint-stock companies were floated in London (p.10). During the boom of the early 1690s, it is likely that “several thousand derivatives were transacted each year”.

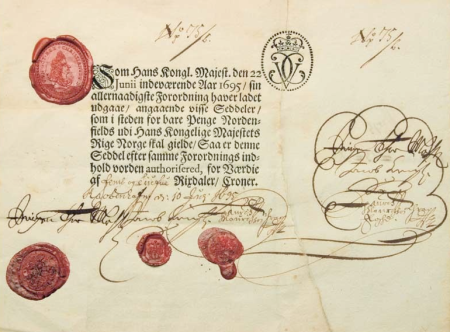

Bochove C. van (2008) Outsourcing financial modernisation

October 11, 2009Bochove, Christiaan van (2008) “Integration of Denmark-Norway in the Dutch capital market”, chapter 4 in The Economic Consequences of the Dutch. Economic integration around the North Sea, 1500-1800, Amsterdam: Aksant, 90-125.

The early modern markets for goods and labour were highly integrated. As the country’s Golden Age came to an end, by 1700, Dutch capital was increasingly finding investment opportunities abroad, chiefly in Great Britain but also in the Danish Kingdom (p.90). It had not always been the case. For instance around 1600, trade with Norway was conducted with cash rather than bills of exchange, a sure sign of poor integration. The concentration of trade in the hands of a local business elite (rather than scattered between small producers) made this modernization possible. By the mid century Norwegian merchants started drawing credit from Amsterdam (p.93). Read the rest of this entry »

Fontaine L. (2008) When relief is worth more than a treasure

October 8, 2009Fontaine, Laurence (2008) “Entre banque et assistance: la création des monts-de-piété”, chapter 6 in L’Economie morale. Pauvreté, crédit et confiance dans l’Europe préindustrielle. Paris : Gallimard, p.164-189.

The first Monti di Pietà (or mounts) were created in 15th-century Italy by Recollet monks to shield the less-fortunate from the scourge of usury. It was not so much intended to pool the poor out of misery as to provide the struggling middle dwellers with a last safety net before falling into poverty (p.164). In the peninsula, the capital hoarded in the safes of the mounts was often diverted from its original aim to be loaned to the rich. It prevented the Italian mounts from becoming really successful. However their model spread over Europe. Read the rest of this entry »

McCant A. (1997) Moral capitalism: investments to feed orphans

October 2, 2009McCants, Anne E.C. (1997) “The Rise and Decline of an Institutional Endowment, in Civic Charity in a Golden Age. Orphan Care in Early Modern Amsterdam, Urbana/Chicago: University of Illinois Press, 151-191.

Numerous elements point to the fact that Dutch charities were well-endowed in the early modern period (p.151). Nonetheless charities were expensive to run and part of the funds came from the beneficiaries themselves. For instance at the Amsterdam Municipal Orphanage, or Bugerweeshuis,

“the orphaned children of poor, but nonetheless, citizen, parents could not be denied entry on the basis of an inadequate inheritance to defray the cost of their support. But the orphaned children of prosperous citizens could also not expect to be cared for entirely at public expenses.”

Nonetheless the bulk of the institution’s resources came from its invested endowment (p.153). Read the rest of this entry »

Dagnino G. B. (1995) When being the first is not enough

September 28, 2009Dagnino, Giovanni Battista (1995) “The Tavola di Palermo: The First Public Bank of Second European XVI century” in Proceedings of the Conference on Business History, October 24 and 25 1994, Rotterdam, eds Mila Davids, Ferry de Goey & Dirk de Witt, 91-111.

The evolution of Sicilian banks reflects the history of the island during the early modern period, in that they were “economically and financially backward” (p.91). The 16th century in the Western Mediterranean was a time of Spanish Domination dominated by (1) money clipping, (2) high inflation, (3) commercial mismanagement, (4) Gresham Law episodes fuelled by unscrupulous financiers and (5) heavy and altogether negative government interventions (p.93). Read the rest of this entry »

Gelderblom O. & Jonker J. (2008) What really brought interests down

September 21, 2009Gelderblom, Oscar & Joost Jonker (2009) “The Conditional Miracle. Institutional change, fiscal policy, bond markets and interest rates in Holland 1514-1713”, Utrecht University Working Papers.

This paper is available online (pdf).

Traditional explanation of the low issuing rate on public debt in the Dutch Republic emphasize the dramatic fall that occurred around 1600, but fail to explain why this level kept on falling from 1640 to 1725, until it had reached 2.5% (p.2). Read the rest of this entry »

Huerta de Soto J. (1996) The Bankers of Seville

September 9, 2009Huerta de Soto, Jesus (1996) “New Light on the Prehistory of the Theory of Banking and the School of Salamanca”, The Review of Austrian Economics, 9/2, 59-81.

This article is available on line (pdf)

Introduction

During the 16th century, all the bankers of Seville inexorably went bankrupt. They were unable to meet the withdrawal demands from their depositors due to insufficient liquidity. Indeed they worked with fractional cash ratio, which allowed them to invest heavily in the shipping and tax collection business they owned and when confronted with an important demand of cash, they simply suspended payment (p.61). “Artificial credit creation, without an adequate base of real saving” was always threatening to push the city into recession. The positive effects of the practice reversed in the second half of the century (p.62). Read the rest of this entry »

Posted by Ben

Posted by Ben